As the United States marches forward with a state-by-state progression towards cannabis legalization, the Lone Star State, Texas, has taken a unique path, incorporating temperance and careful action as it navigates the evolving cannabis landscape. While Texas does have a small medical cannabis program in place, another player has quietly emerged in the cannabis arena as the market share leader: hemp. As the state appears to be approaching the possibility of broader cannabis legalization, it's essential to understand Texas' distinctive approach and how hemp is taking center stage.

Texas: A Unique Approach to Cannabis

Texas' journey in cannabis legalization has been marked by a distinct blend of cautiousness and an evolving medical cannabis program. Despite these complexities, the state is gradually moving towards embracing cannabis on its own terms in response to the unique set of dynamics on the ground and hard lessons learned from other state cannabis markets. This wait and see approach has served the state well in terms of intelligence gathering. The more Texas learns from other markets in conjunction with waiting for additional federal legal clarity, the less likely the program will falter from previous mistakes.

The Ongoing Debate

The debate surrounding cannabis in Texas continues, even after a century since the state first banned it. Currently, cannabis remains illegal in the state, however, the largest counties in the state have decriminalized minor possession of cannabis (high THC cannabis or marijuana). Possession of more than four ounces even in those counties is still considered a felony.

In 2015, Texas enacted the Compassionate Use Act, creating a limited medical cannabis program. Currently under this program, only low-Delta-9 THC, non-combustible products with a maximum strength of 1% by weight are allowed, and it can be prescribed for a specific list of severe conditions, including epilepsy, terminal cancer, autism, and more.

Support for a Broader Cannabis Reform

Texas Representative Joe Moody from El Paso has been a long-time advocate for adult-use cannabis. He co-authored pro-cannabis bills, including ones that aimed to expand the covered medical conditions and decriminalize cannabis statewide. Although these bills passed in the House of Representatives, they faced the typical hurdles in the Senate. The legislature will reconvene in January 2025 to consider a host of issues that may expand decriminalization and medical programs even more. Until new legislation is enacted, the medical cannabis program will remain in its infancy. This stalemate has left the door open for the hemp market to thrive.

The Future of Medicinal Cannabis in Texas

Currently, Texas has only three official licensees, and only two are operational, serving the state's approximately 61,000 registered patients. The total number of 61,000 patients is a historical representation of all patients and not the number of active patients in the program. The number of active patients is likely only a third to a half of all of the historically registered patients. These medical cannabis dispensaries rely on a network of satellite "partner locations" that are open for an average of just a few days a week. The limited program and accessibility underscore the obvious predicament that is twofold: the state’s population is not adequately being served and the business climate to run a financially healthy operation is an uphill battle.

In early 2023, the Texas Department of Public Safety accepted over 130 applications for new medical dispensary licenses, with each licensee required to be vertically integrated, covering the entire seed-to-sale process under one license. It is unclear if any additional licenses will be issued given the complexity of the evolving hemp market and lack of federal legal clarity. In fact, the DPS tempered expectations of granting additional licenses at its public safety commission meeting on August 24, 2023, stating the medical cannabis market hasn’t changed much since the last legislative session. [1]

Looking Ahead: Market Potential Beyond Medical Cannabis

The path forward for adult-use cannabis in Texas is a matter of ongoing debate. Representative Joe Moody sponsored the Texas Regulation & Taxation of Cannabis Act, aiming to open discussions about a retail cannabis market in Texas. The bill proposes a 10% cannabis tax, requirements for licenses for various cannabis-related activities, and a legal age of 21 for sale and consumption, among other provisions.

The potential for a fully developed medical cannabis market in Texas can be seen by examining the example of Florida, a smaller state with a mature medical cannabis market. With Texas' larger population, the potential for a fully open, mature medical cannabis market is significant. Yet, on the same token and despite the robust medical cannabis program, Florida currently also has the largest US addressable market demand for hemp-derived products of any state [2].

Furthermore, Texas, with its business-friendly environment, if it succeeds to avoid the mistakes that have plagued larger states like California and New York, still has the greatest cannabis potential. The state should retain a strong and careful focus on creating a robust, regulated medical and even adult-use cannabis market, but in the meantime, hemp is the real contender.

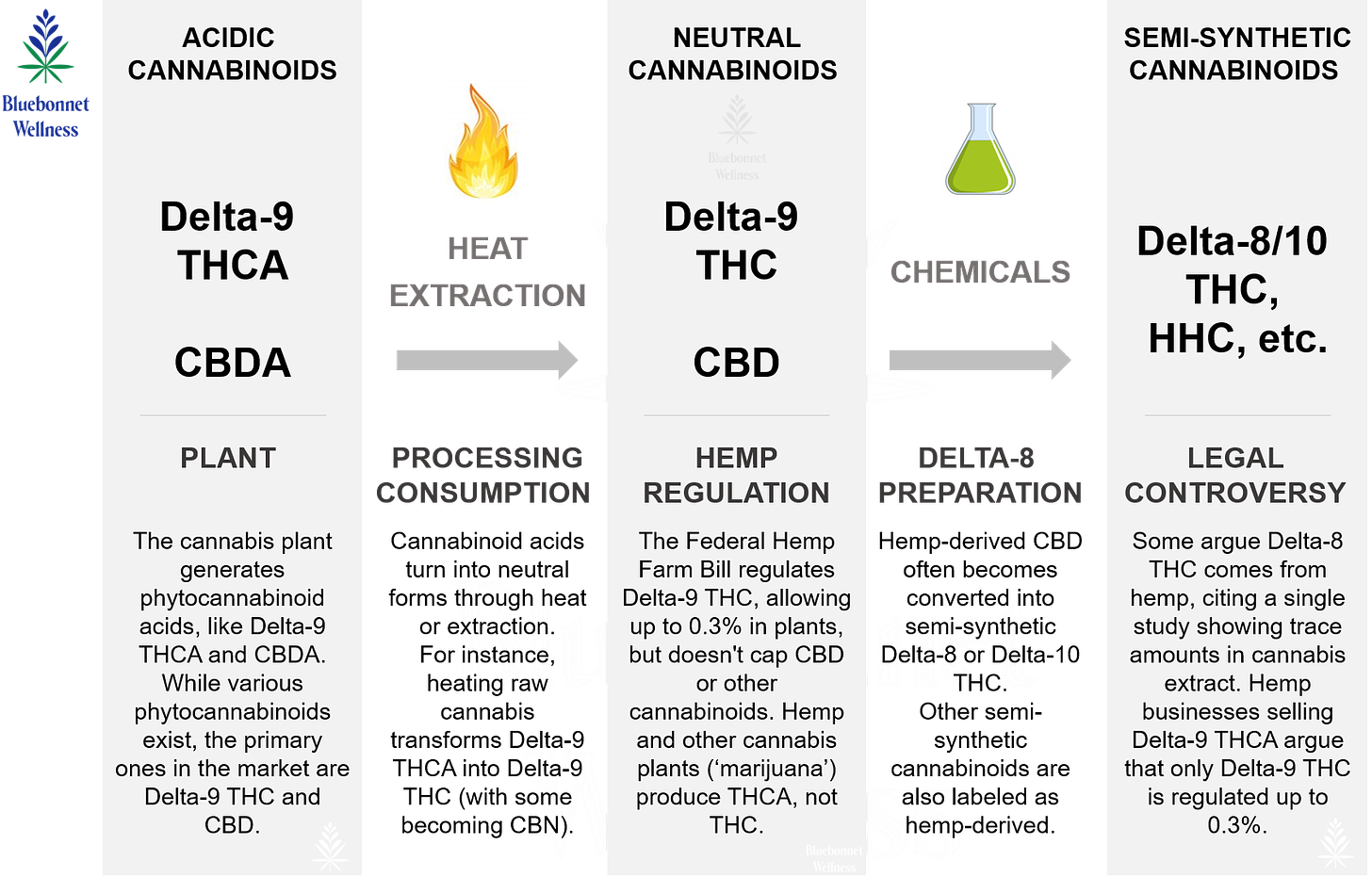

The Rise of Hemp

Hemp has gained prominence in Texas, thriving in the "back door" of the cannabis industry. After the initial rise and fall of hemp CBD focused products, we saw an emergence in alternative hemp derived products that were developed for consumers disenchanted with the lack of an effect or “high” from consuming just CBD products. Manufacturers quickly realized that selling other hemp derived cannabinoids with more of an “effect” filled the market void. Initially, in 2022, Texas saw an explosion of large format edibles that contained 0.3% Delta-9 THC or less, which is 3 milligrams per gram, resulting in 5-gram products that contained up to 15mg or more per dose. Currently in Texas, stores also sell Delta 8 and Delta-10 THC, CBD, and even Delta-9 THCA products, arguing they are adhering to the federal 2018 Farm Bill's requirement of less than 0.3% THC. The infographic below illustrates the rationale behind selling these products under the guise of the hemp farm bill and also under the existing unregulated hemp-derived product market.

These psychoactive hemp products are available everywhere in all kinds of retail stores, gas stations, online in Texas and even via the interstate trade, creating a robust Texas hemp-derived market to the tune of $2 billion in revenue and in the addressable market demand, placing Texas in the top among twenty-three states that allow hemp-derived product sales [2, 3]. Presently, consumers in Texas can simply purchase a multitude of various widely available natural and semi-synthetic cannabis products for self-medication without consulting a healthcare practitioner or registering as a patient. Unlike, Delta-9 THC, there is significant lack of knowledge on the mechanisms and effects of the semi-synthetic Delta-8 and Delta-10 THC, etc. The hemp businesses moreover do not have to abide by the same regulations, are not required to have standardized methods of production of the chemically altered cannabinoids or face the same taxation and financial obstacles of legal state medical cannabis operators. Which begs the question: how can state compliant medical cannabis businesses possibly compete in this current environment?

The Road Ahead

The barriers to entry for the legal cannabis market compared to the hemp derived market could not be starker. The cost to compete in the regulated, vertically integrated cannabis market in Texas, subject to 280E and the state regulatory hurdles is quite high. Conversely, obtaining a Texas hemp license, creating a product or white labeling it, and ultimately selling it to Texans does not require the significant capital investment as a TCUP license. Moreover, the actual business of manufacturing and selling a hemp product is not subject to enormous business hurdles that make it almost impossible to operate in a financially viable way.

The future of cannabis in Texas is marked by strong public support for both decriminalization and adult-use. A growing number of Texans favor legalizing cannabis for various purposes, and the momentum for change is building.

While the full picture of cannabis in Texas is still taking shape, one thing is certain: Texas will embrace cannabis in its unique way, reflecting the market realities and landscape on the ground. As the state moves forward, it remains to be seen how hemp and medical cannabis will coexist and evolve in the Texas cannabis landscape. The winners today may have to pivot to stay relevant tomorrow. Ultimately, the long-term goal is to ensure that Texans are the primary beneficiaries of a sensible and responsible cannabis program.

Copyright Bluebonnet Wellness 2023 © by Adendox, LLC.

REFERENCES:

https://cdn.www3.dps.texas.gov/cdn/ff/wqYPF22aKN3MjRBSIpSdpCgDO4xYPJEt4L5v87uslKQ/1692208810/public/psc_calendar/2023/PSC%20Meeting%20Agenda%2008242023.pdf

https://www.whitneyeconomics.com/ Beau R. Whitney and Beau Wilberding. 2023 National Cannabinoid Report. October 2023

https://cannabisindustryjournal.com/feature_article/cannabis-in-texas-a-look-ahead-to-legalization-and-beyond/